If you have children and grandchildren, there are two terms you should become familiar with. Per stirpes and per capita are terms that when used in a will, retirement account or other document, will determine how your estate is distributed. If you name your children as either primary or secondary beneficiary, then you should decide whether you want to use the designation “per stirpes”, “per capita” or neither.

Example: If you name your spouse as primary beneficiary and you name your children (you should specifically give their names) as secondary beneficiary (sometimes called contingent beneficiary or alternate beneficiary) you can stipulate that you want “Per Stirpes” or “Per Capita at each generation” (you don’t have to choose one of these, they are just options).

Basically if you choose Per Stirpes, if your spouse is deceased, your children will inherit equally, but if one child predeceases you, their children would inherit their percentage. For example, if you have 3 children and 1 is deceased (and the deceased child has children), then the two living children would inherit 1/3 each, and the other 1/3 would be divided equally by the children of the deceased child. If the deceased child had no children, then the living children would inherit ½ each (unless otherwise stipulated in the will). In this same example, if 2 children were deceased (and they both have children), then the children of the 1st deceased child would split 1/3 of the estate and the children of the 2nd deceased child would split 1/3 of the estate, no matter how many children either of them have.

If you choose Per Capita at each generation, and if you have 3 children, and 2 are deceased (both having children), the living child would inherit 1/3 of the estate, and all of the children for the 2 deceased children would inherit the same percentage; even if there are 3 children to one family and 1 child to the other family – all 4 children would inherit the same percentage. The 4 children would inherit 2/3 of the estate divided by the 4 children. If the deceased children did not have children, then the entire estate would go to the living child.

There is no right or wrong way to name your beneficiaries; it just depends on what your wishes are.

The following definitions and explanations may make this clearer. The diagrams should help you determine how you would like to list your beneficiaries in your will or other document. The following definitions, explanations and diagrams are from Wikipedia.org:

“Per stirpes is a legal term in Latin. An estate of a decedent is distributed per stirpes if each branch of the family is to receive an equal share of an estate. When the heir in the first generation of a branch predeceased the decedent, the share that would have been given to the heir would be distributed among the heir’s issue in equal shares. It may also be known as right of representation distribution, and differs from distribution per capita, as members of the same generation may inherit different amounts.[1]

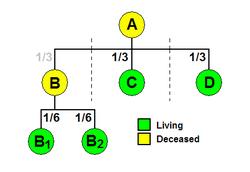

Example – per stirpes

Figure 1. A‘s estate is divided equally between each of the three branches. B, C, and D each receive one-third. As B pre-deceased A, B‘s two children – B1 and B2 – each receive one-half of B‘s share, equivalent to one-sixth of the estate.

Example 1A: The testator A, specifies in his will that his estate is to be divided among his descendants in equal shares per stirpes. A has three children, B, C, and D. B is already dead, but has left two children (grandchildren of A), B1 and B2. When A‘s will is executed, under a distribution per stirpes, C and D each receive one-third of the estate, and B1 and B2 each receive one-sixth. B1and B2 constitute one “branch” of the family, and collectively receive a share equal to the shares received by C and D as branches.

Per capita at each generation

Per capita at each generation is an alternative way of distribution, where heirs of the same generation will each receive the same amount. The estate is divided into equal shares at the generation closest to the deceased with surviving heirs. The number of shares is equal to the number of original members either surviving or with surviving descendants. Each surviving heir of that generation gets a share. The remainder is then equally divided among the next-generation descendants of the deceased descendants in the same manner.

Example 2A: In the first example, children C and D survive, so the estate is divided at their generation. There were three children, so each surviving child receives one-third. The remainder – B‘s share – is then divided in the same manner among B‘s surviving descendants. The result is the same as under per stirpes because B‘s one-third is distributed toB1 and B2 (one-sixth to each).

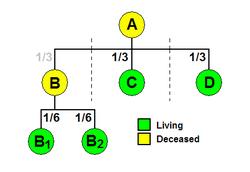

Figure 2. Comparison between per stirpes inheritance and per capita by generation inheritance. On the left, each branch receives one third of the estate. On the right, A‘s only surviving descendant, C, receives one third of the estate. The remaining two thirds are divided among the descendants in the next generation.

Example 2B: The per capita and per stirpes results would differ if D also pre-deceased with one child, D1 (figure 2). Under per stirpes, B1 and B2 would each receive one-sixth (half of B‘s one-third share), and D1 would receive one-third (all of D‘s one-third share). Under per capita, the two-thirds remaining after C ‘s one-third share was taken would be divided equally among all three children of B and D. Each would receive two-ninths: B1, B2, and D1 would all receive tw